Making Tax Digital checklist for sole traders and landlords

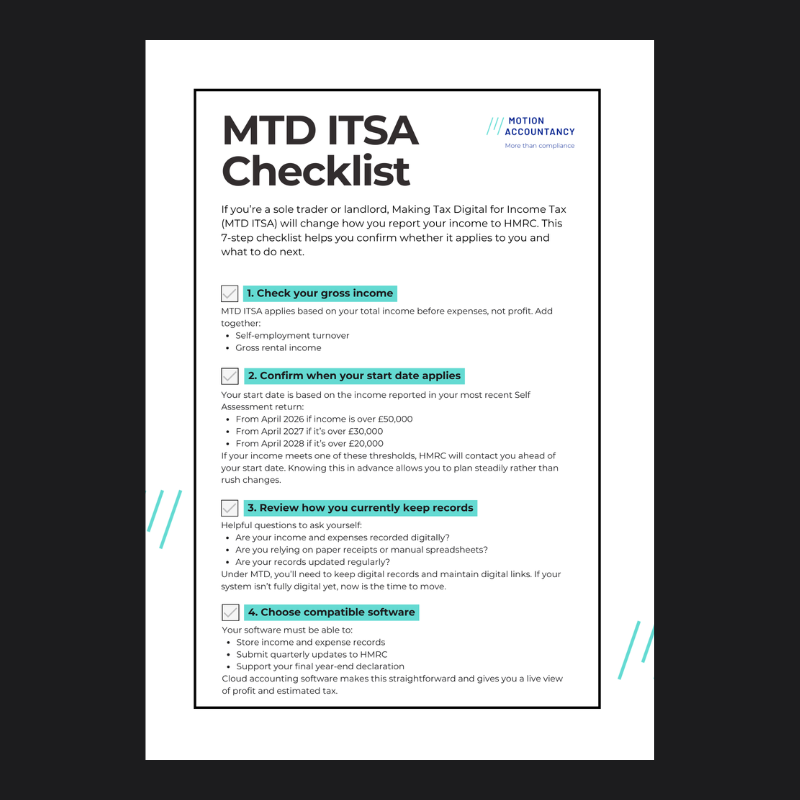

If you’re a sole trader or landlord, Making Tax Digital for Income Tax will change how you report your income to HMRC. This checklist helps you confirm whether it applies to you and what to do next.

If you’d like help confirming your position and getting everything set up properly, get in touch. We’ll guide you through it in a steady, practical way that supports both compliance and better tax planning.