MAKING TAX DIGITAL

For a stress-free transition

Digital record-keeping and quarterly reporting are becoming the norm. We’ll show you exactly what applies to you, what needs to change and how to stay compliant without adding more pressure to your day-to-day.

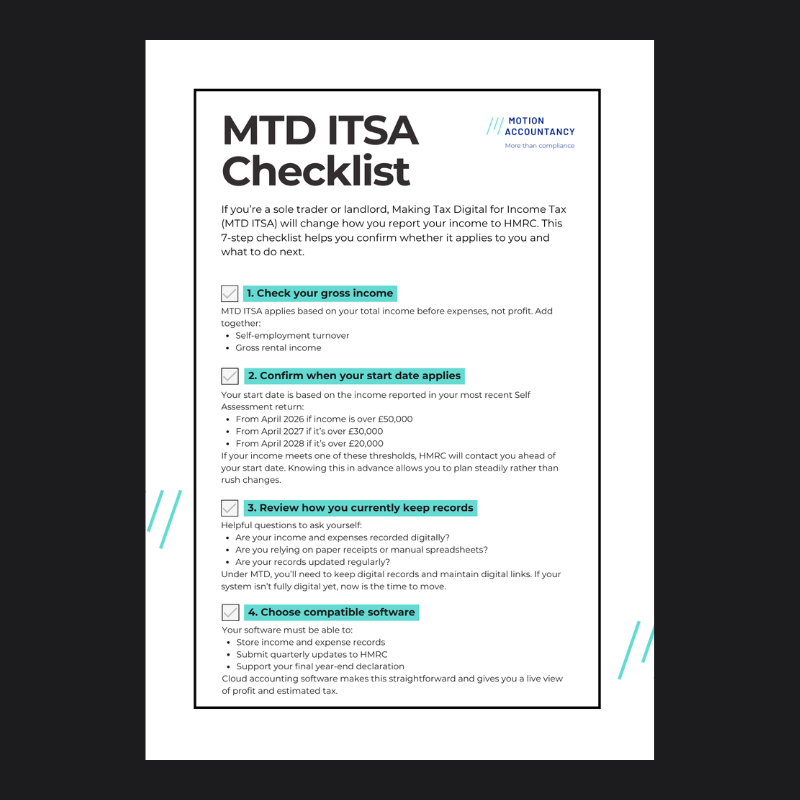

Making Tax Digital checklist for sole traders and landlords

If you’re a sole trader or landlord, Making Tax Digital for Income Tax will change how you report your income to HMRC. This checklist helps you confirm whether it applies to you and what to do next.

Making Tax Digital for Income Tax FAQs

Making Tax Digital is HMRC’s move to digital record-keeping and quarterly reporting. This guide explains who is affected, what’s changing and how to stay compliant.

When will I need to start Making Tax Digital?

Making Tax Digital starts from April 2026 for sole traders and landlords above the income thresholds, while VAT-registered businesses are already included.

Making Tax Digital penalties and compliance

MTD uses a points-based penalty system for late submissions. Understand how it works and how to avoid unnecessary fines.

What software do I need for Making Tax Digital?

MTD requires compatible digital software. Learn what counts, whether spreadsheets are allowed and how to choose the right system for your business.

Does Making Tax Digital affect limited companies?

MTD already applies to limited companies registered for VAT. Directors paid under PAYE are only included in MTD for income tax if they have income from other, relevant sources.